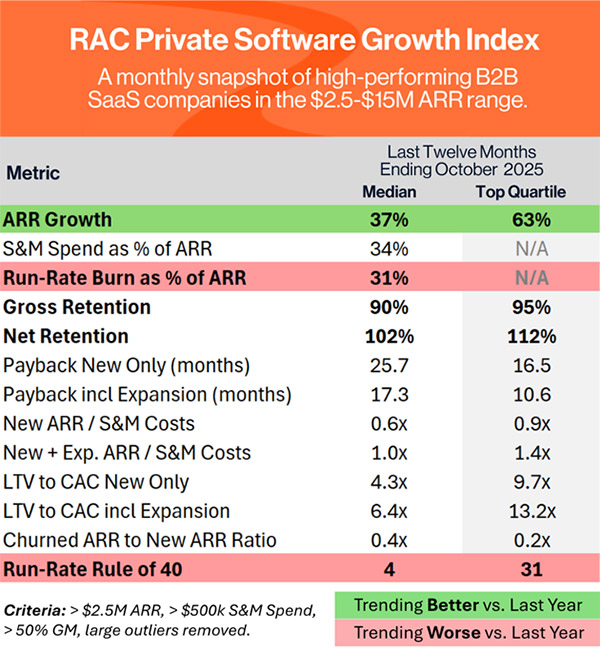

RAC’s Private Software Growth Index: October 2025

Every year, we have the privilege of meeting with hundreds of software companies, many of them in our ‘sweet spot’ of $2.5-$15 million in annual revenue. From those conversations and screens, we’ve assembled the RAC Private Software Growth Index, a set of key performance indicators aggregated across the 400+ companies we’ve reviewed in detail.

We update this Index each month on a rolling Last Twelve Month basis and use it as a benchmark to help drive priorities within our portfolio, and we hope you’ll find it useful as well. The data set is unique as it comes from data calculated directly from a company’s financial statements and exclusively tracks growth-stage, business-to-business software companies.

Here's what's that Index looks like for last month:

To learn more about the Private Software Growth Index and how it was constructed, please see the disclosure at the bottom of this post.

What stands out in the data?

Growth in the Private Software Growth Index remains quite strong, with the median growth rate at 37%, and top quartile at a healthy 63%. Both figures are flat compared to the year before (meaning that growth is neither accelerating nor decelerating compared to last year).

We are continuing to see burn rates increase in the Index compared to one year ago--with the extra spending coming from investment in product/R&D. Investment levels in sales and marketing have remained flat compared to last year. Software remains quite “sticky”, with median gross retention at 90% and median net retention still above 100%.

A particular bright note is that sales and marketing spend appears to be getting more efficient, with payback periods generally trending down (possibly AI efficiencies in GTM processes?). However, the increased spend on product/R&D referenced above is resulting in a general deterioration in the Rule of 40...even top quartile Rule of 40 currently stands at just 30%.

The big question: Will the need for constant product innovation in the age of AI mean that Rule of 40 will be permanently lower than it was in the past? Or will AI-driven operational efficiencies balance it out? We’d love to hear your thoughts.

Interested in receiving the data straight to your inbox each month?

Subscribe to our ‘Off The RAC’ newsletter for our monthly Private Software Growth Index, along with highlights from across RAC and our portfolio companies.

We love meeting new software companies, so let's talk.